What is a dental insurance deductible?

You shopped around for dental insurance, considered the coverage options, and compared costs. You're ready to make your final decision when you notice one more dollar amount — the deductible. What in the world is a dental insurance deductible anyway? And what's the difference between the dental deductible and other out-of-pocket costs like copays and coinsurance?

We know insurance can be confusing but fear not. Deductibles are one of the most straightforward aspects of dental benefits.

How Dental Insurance Deductibles Work

Simply put, a dental insurance deductible is the annual dollar amount you pay directly to your dentist for covered services before your dental plan begins to pay. It's one piece of the "out-of-pocket" puzzle.

Deductible amounts are set for 12-month periods and get reset when a new coverage period begins. Most dental plan providers, including Delta Dental of Washington, will set their benefit periods to either follow the calendar year or are set on an annual (non-calendar) basis.

There are two types of annual dental insurance deductibles: at the individual level and at the family level.

Individual deductibles are pretty simple. When your dentist submits a claim for a treatment, you'll pay your annual deductible first before your insurance kicks in. If you received a previous treatment during that coverage period and already paid your deductible for the year, you won't have to pay it again. From there, any additional cost you pay out-of-pocket (OOP) will be determined based on the details of your plan.

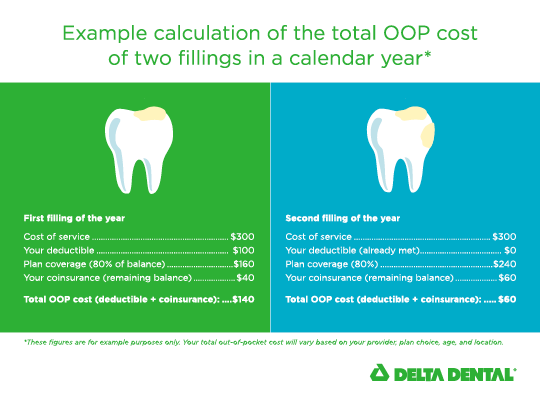

For example, let's say you need to get a cavity filled, which costs $300. Your deductible for the year is $100 and your plan covers 80% of the cost of fillings after you've paid the deductible. You'll first pay $100 to your dentist, leaving a balance of $200. That remaining $200 is then covered at 80%, meaning your insurance plan will pay $160 to your dentist. This leaves a remaining balance of $40, which you'll pay out-of-pocket (this is known as your coinsurance.) As a result, your total out-of-pocket cost for treatment will be $140.

However, if you need a second cavity filled during the same benefit period, you won't need to pay any further deductible since you've already met it. Your insurance plan should cover 80% of the total cost of treatment, meaning they'll pay $240 of the $300, and you'll pay $60.

When it comes to family dental insurance, deductibles can get slightly more confusing. Family plans often carry a "per person" deductible as well as a family deductible. This means that each person on the plan has their own separate deductible that feeds into the family's.

For example, say you have a family of five on a plan that carries a family deductible of $400, and "per person" deductibles of $100 each. The family deductible will be met once four of those five individual deductibles have been paid.

Do All Dental Services Count Toward My Deductible?

What does and doesn't count toward your deductible depends on the details of your dental plan. Some plans have deductibles for all treatments, while other plans waive deductibles for diagnostic and preventive services. These preventive treatments encourage good oral health and reduce the need for more complicated and costly procedures later, which is why most Delta Dental plans offer complete coverage with no deductibles for preventive cleanings, exams, x-rays, and fluoride.

Your plan policy or benefit summary should clearly lay out all of the details of your particular plan.

What About No-Deductible Dental Insurance?

Yes, you can find dental insurance with no deductible, but keep in mind that these plans are often the most basic, offering little to no coverage beyond preventive treatments or partial coverage for fillings. They may also come with hefty copays that other plans don't. That said, you may feel like you only need coverage for preventive treatments, in which case, a no-deductible dental plan might be just what you need.

Of course, understanding your dental insurance deductible is only one part of making an informed decision about your plan. Premiums, deductibles, copays, and coinsurance can seem complicated, but a little research can really help simplify the process.

Of course, understanding your dental insurance deductible is only one part of making an informed decision about your plan. Premiums, deductibles, copays, and coinsurance can seem complicated, but a little research can really help simplify the process.